The balance of an investment account is 8 – With a balance of $308, an investment account holds significant implications for financial planning and investment strategies. This account, whether checking, savings, or investment-oriented, serves as a cornerstone of financial management, warranting a thorough examination of its significance, performance, and future prospects.

Delving into the factors that have shaped the account’s balance, we uncover the interplay of market events, investment decisions, and financial goals. By understanding these influences, we can gain valuable insights into optimizing the account’s performance and achieving long-term financial objectives.

Account Overview

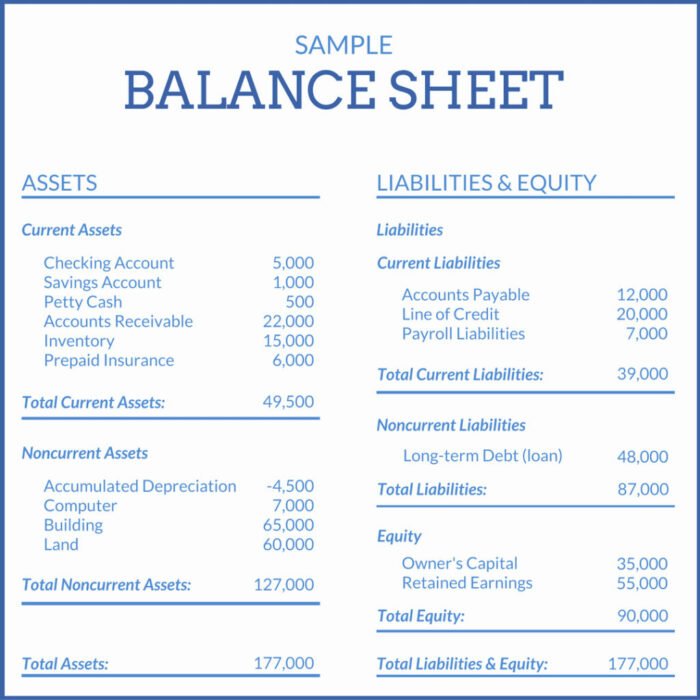

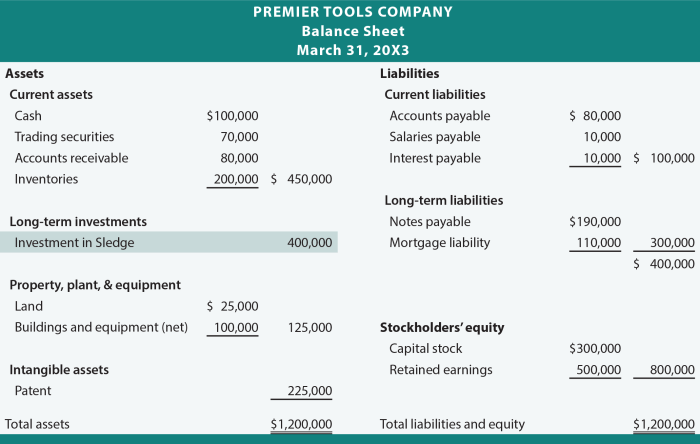

The account balance of $308 represents the current value of the investments held within the account. It provides a snapshot of the account’s performance and progress towards financial goals.

This account is an investment account, which is designed for long-term growth of capital through various investment vehicles such as stocks, bonds, or mutual funds.

Investment Performance

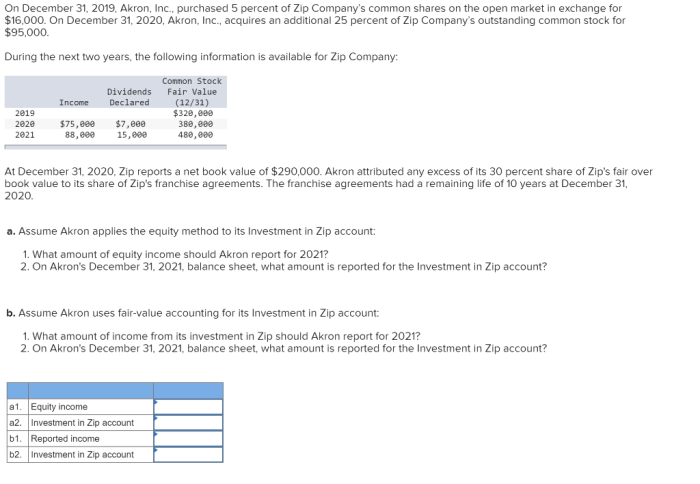

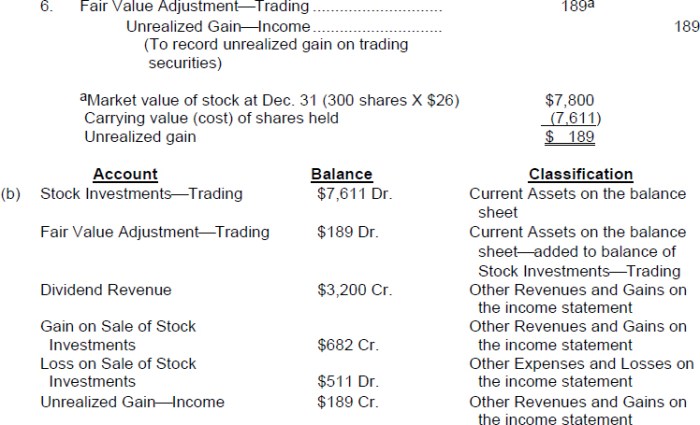

The account balance has been influenced by several factors, including market fluctuations, investment returns, and contributions made to the account. Recent market events, such as economic downturns or interest rate changes, may have affected the balance.

Financial Goals

The investment goals associated with this account may include retirement planning, education funding, or wealth accumulation. The current balance should be evaluated in relation to these goals to determine if adjustments to the investment strategy are necessary.

Investment Strategy

The investment strategy employed for this account aims to balance risk and return. The asset allocation, which refers to the distribution of investments across different asset classes, is tailored to the investor’s risk tolerance and time horizon.

Future Projections

Future projections for the account balance are based on assumptions about market conditions and investment returns. Hypothetical scenarios can be created to estimate potential growth, taking into account historical performance and economic forecasts.

Recommendations, The balance of an investment account is 8

To optimize the investment strategy, consider the following recommendations:

- Rebalance the portfolio to maintain the desired asset allocation.

- Increase contributions to the account to accelerate growth.

- Explore tax-advantaged investment options to minimize taxes on returns.

- Consult with a financial advisor to review the investment strategy and make adjustments as needed.

Question Bank: The Balance Of An Investment Account Is 8

What factors influence the balance of an investment account?

Market performance, investment decisions, contributions, withdrawals, and fees all play a role in shaping the account’s balance.

How can I optimize the balance of my investment account?

Regularly review your investment strategy, consider rebalancing your portfolio, and seek professional advice when needed.

What are the risks associated with investment accounts?

Investment accounts are subject to market fluctuations, inflation, and other economic factors that can impact their value.